If you’re an entrepreneur in India aiming to use Stripe in India, you’ve likely run into service limits already . As of May 2024, Stripe is invite‐only—businesses in India cannot directly sign up for a new account through the website and must instead request an invite, with only a small number of companies approved at any time (Stripe Support).

In this guide, we’ll show you an effective workaround: how to open a U.S.–based Stripe account from India by forming a U.S. LLC through a service like Bizee and then using Payoneer to obtain U.S. banking details for Stripe payouts you can redeem locally in India (The Economic Times). Let’s dive in!

Why This Works

To use Stripe in India ,you simply need to form a U.S. company (an LLC) and choose United States as your operating country when registering at Stripe.com (Stripe Support). Stripe requires a U.S. legal entity, a U.S. address, a U.S. phone number, and a U.S. bank account for payouts (Stripe Docs). By creating a U.S. LLC, obtaining an Employer Identification Number (EIN), and using Payoneer’s U.S. receiving account, you meet every requirement—no U.S. Social Security Number or physical presence needed (Stripe Support, Stripe Docs).

Step 1: Form Your U.S. LLC

What Is an LLC?

A limited liability company (LLC) is a U.S. business structure that shields owners’ personal assets from company debts and lawsuits (Investopedia).

Common Questions, Answered

- Do I need to be a U.S. citizen or resident? No—foreign nationals can form an LLC (IRS).

- Do I need a physical U.S. address? You only need a registered agent’s address, which your formation service provides (IRS).

- Do I need a U.S. Social Security Number? No—your EIN (issued when you form the LLC) suffices (Wolters Kluwer).

Most Affordable States to Form an LLC

As of 2025, these three states offer the lowest combined filing and annual maintenance fees for an LLC:

- Mississippi

- Formation Fee: $50 (LLC University®)

- Annual Report Fee: $0 (report required by April 15) (LLC University®)

- Missouri

- Formation Fee: $50 (LLC University®)

- Annual Report Fee: $0 (no report required) (LLC University®)

- New Mexico

- Formation Fee: $50 (LLC University®)

- Annual Report Fee: $0 (no report required) (LLC University®)

Why Inc Authority Is the Must-Go Choice

After comparing various LLC formation services, Inc Authority stands out as the top choice for Indian entrepreneurs seeking to establish a U.S.-based Stripe account. Here’s why:

- Free LLC Formation: Inc Authority offers a $0 LLC formation package, requiring only the state filing fees.(Small Business HQ)

- Free Registered Agent for the First Year: They provide a registered agent service free for the first year, a crucial component for maintaining compliance.(CorpNet)

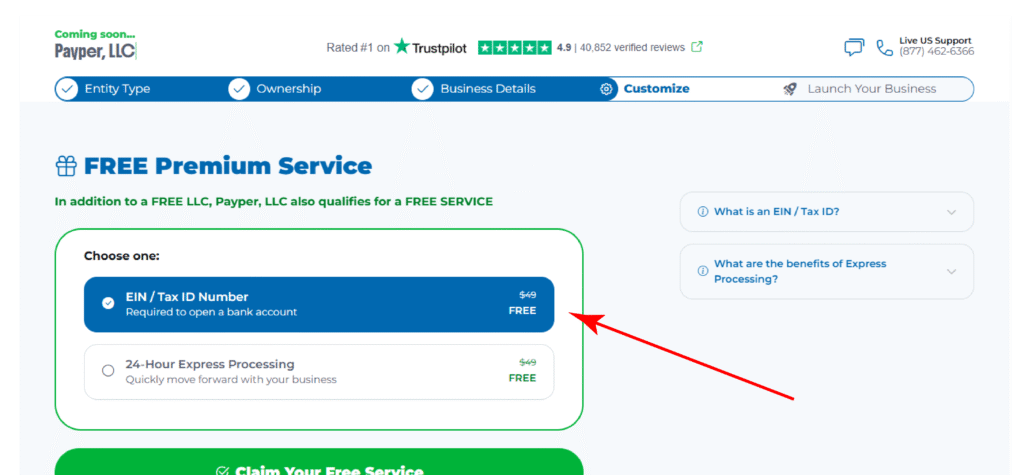

- Free EIN Acquisition: Obtaining an Employer Identification Number (EIN) is essential for opening a U.S. bank account and setting up Stripe. Inc Authority includes this service at no additional cost.

- High Trustpilot Rating: With a Trustpilot score of 4.8, Inc Authority is praised for its reliability and customer service.(CorpNet)

- Established Experience: Having assisted over 250,000 businesses since 1989, Inc Authority brings decades of experience to the table.(Small Business HQ)

LLC Formation Services Comparison

| Service | Formation Cost | Trustpilot Rating | Free EIN | Free Registered Agent (1st Year) |

|---|---|---|---|---|

| Inc Authority | $0 + state fees | 4.9⭐ | ✅ | ✅ |

| Bizee (formerly Incfile) | $0 + state fees | 4.7⭐ | ❌ | ✅ |

| Stripe Atlas | $500 | N/A | ✅ | ✅ |

| ZenBusiness | $0 + state fees | 4.7⭐ | ❌ | ❌ |

| Northwest Registered Agent | $39 + state fees | 3.3⭐ | ✅ | ✅ |

Note: Trustpilot ratings are based on available data as of 2025.

By choosing Inc Authority, you benefit from a cost-effective and reliable service to establish your U.S. LLC, a critical step in setting up a Stripe account from India. Their comprehensive offerings simplify the process, making it accessible even if you’re new to international business operations.

Disclaimer: The information provided is based on available data as of 2025. Please verify current services and offerings directly with the providers.

Before moving ahead with Bizee, you’ll first need to get your U.S. address and phone number. These are required both during your LLC formation and later while opening a U.S. bank account.

Step 1.1: Get Your U.S. Phone Number to use Stripe in India

Before you start forming your LLC, you’ll need a U.S. phone number. This is a small but essential detail—many platforms (including Stripe, IRS, and your registered agent) may need to send OTPs or verify your identity through a U.S. number.

Recommended: MoreMins

MoreMins offers affordable U.S. virtual phone numbers via their mobile app.

- Features: Free incoming calls and texts, outgoing calls at low rates

- Pricing: Starts at $0.99/month

- Website: MoreMins

Once you have your number, the next step is to get a U.S. business address.

Step 1.2: Get Your U.S. Address

You’ll need a valid U.S. address for:

- LLC registration with Bizee

- EIN application

- Stripe setup

Recommended: iPostal1

iPostal1 offers over 3,500 real U.S. addresses—not PO boxes—and includes mail forwarding, scanning, and package handling.

- Pricing: Starts at $9.99/month

- Features:

- Mail forwarding

- Real physical street address—not PO boxes

- PDF mail scanning

- Real-time shipping quotes

- Address consolidation

Website: iPostal1

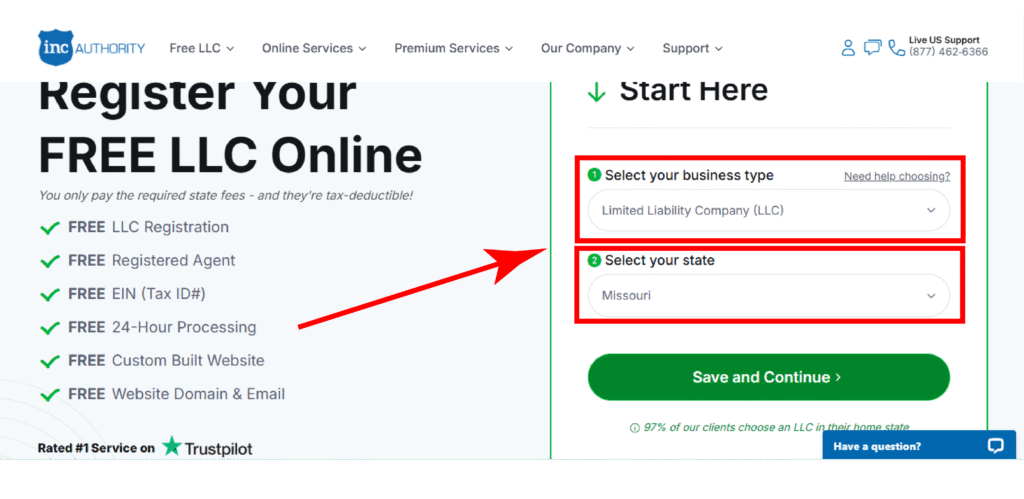

Step 1.3: Step-by-Step Tutorial (Inc Autorithy)

Once you have your U.S. phone number and address, head back to Bizee and follow these steps:

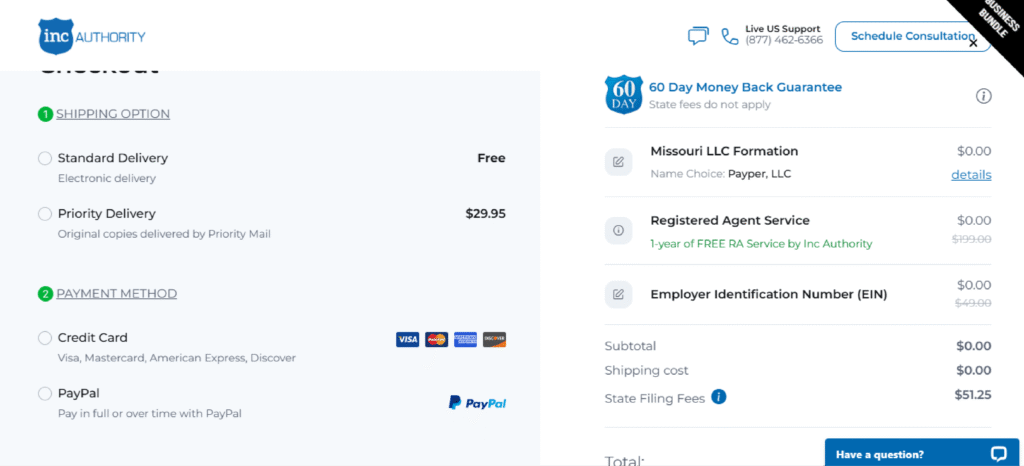

Step 1. Browse the Inc Authority website. Select LLC as your business type , and choose one among the cheapest states. We chose Missouri in our example.

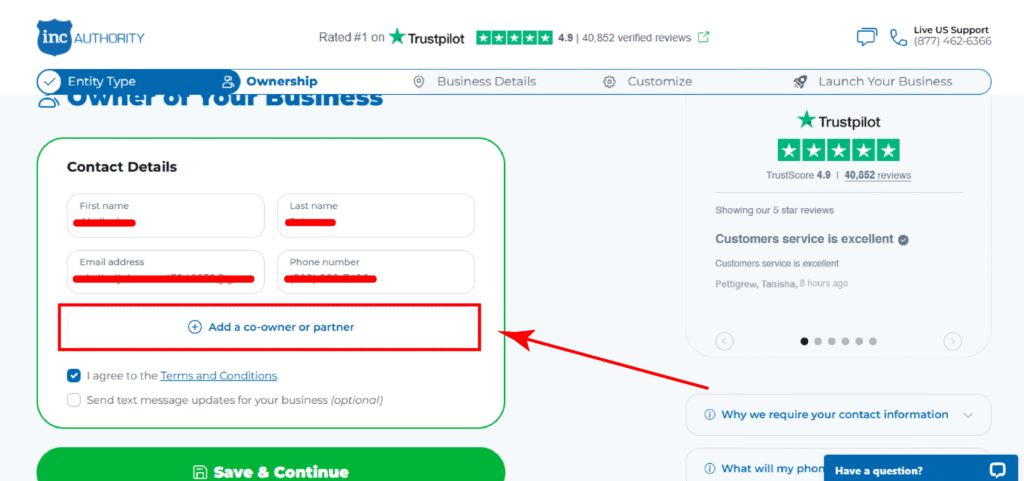

Step 2. You will be asked to complete a profile. Then you will have to enter your contact details , if you’re opening your LLC alongside partners this is the right time to also add their details.

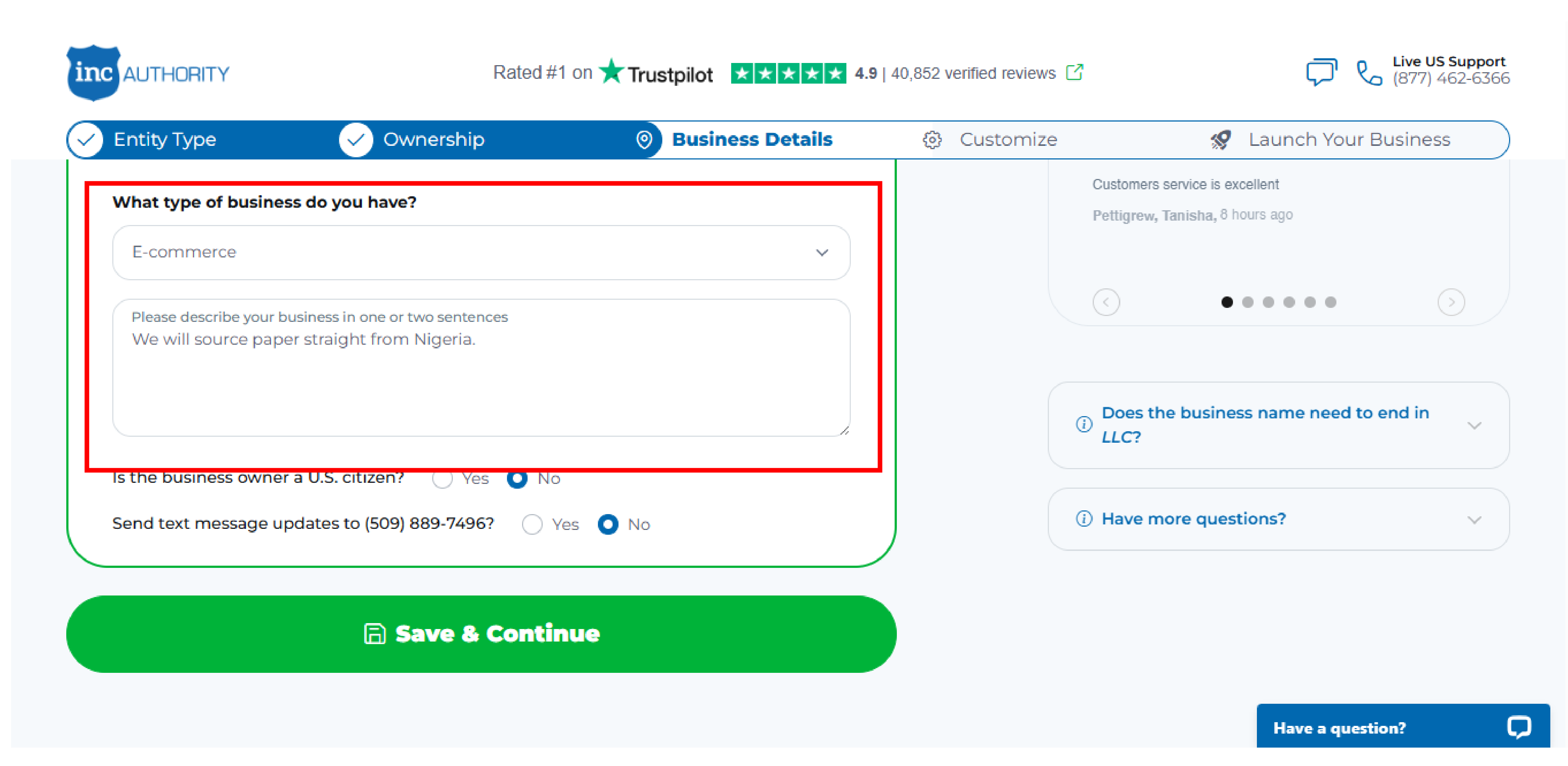

Step 3. Fill in your company information which includes your LLC name and business purpose.

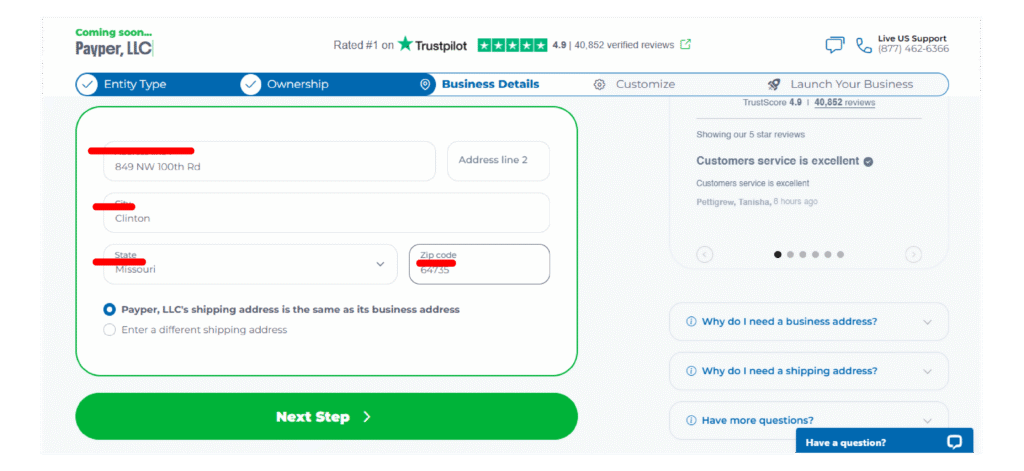

Step 4. As mentionned earlier at this satge you should have alraedy bought your real physical US adress from iPostal simply use it there.

Step 5. Claim your free EIN.

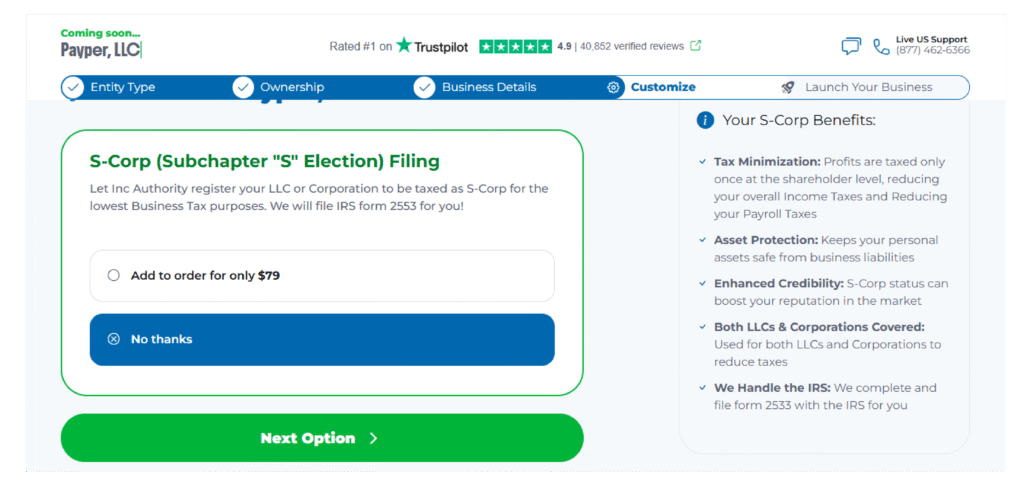

Step 6. If your business is earning under $40,000 in profit per year, sticking with a regular LLC is usually the smartest and simplest choice. But once you’re consistently making over $50,000 in profit, electing to have your LLC taxed as an S-Corp can help you save on self-employment taxes — as long as you’re prepared for the added responsibilities like running payroll and filing extra tax forms. For most small business owners, it’s best to start simple and upgrade your tax strategy when your income justifies it.

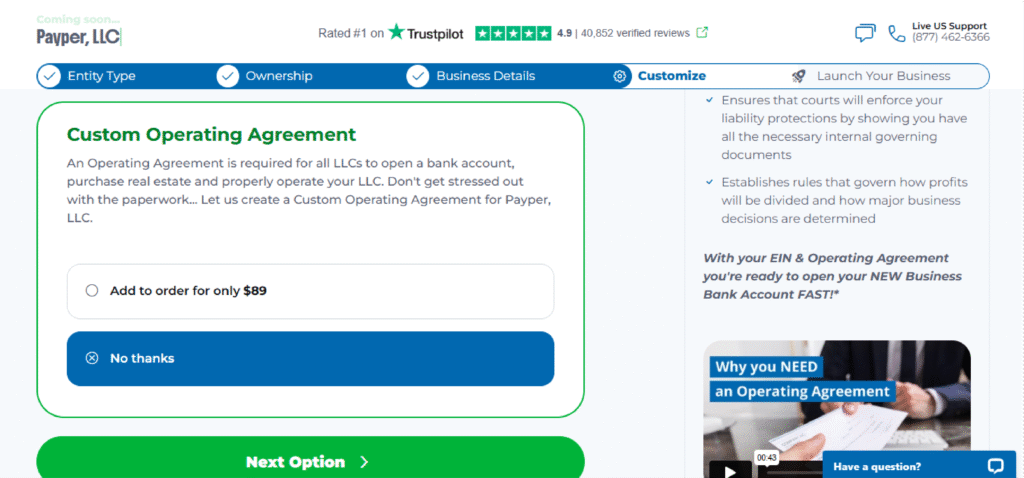

Step 7. If you’re a solo business owner, an Operating Agreement isn’t legally required in most states — but it’s still a smart move especially if your opening your LLC alongside partners. It outlines how your LLC is run, protects your limited liability status, and shows banks or investors you’re serious. Skipping it might save money upfront, but it can cost you big in confusion or conflict later. Better to set expectations early and keep things professional.

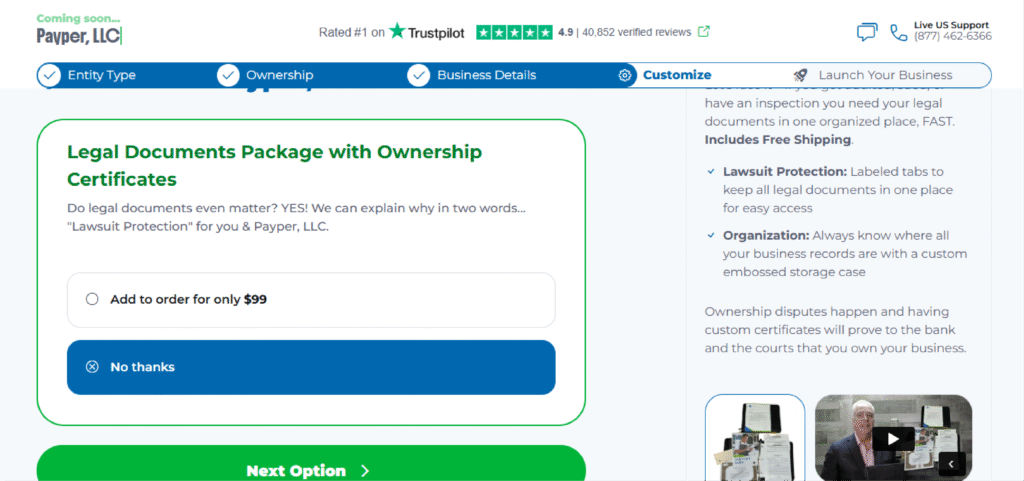

Step 8. You can skip creating ownership certificates for your LLC — they’re not legally required in most states. While they can look professional and help clarify ownership, the official record of who owns what is typically covered in your operating agreement. So unless you just want them for presentation or internal documentation, they’re optional and not something you need to worry about when starting out.

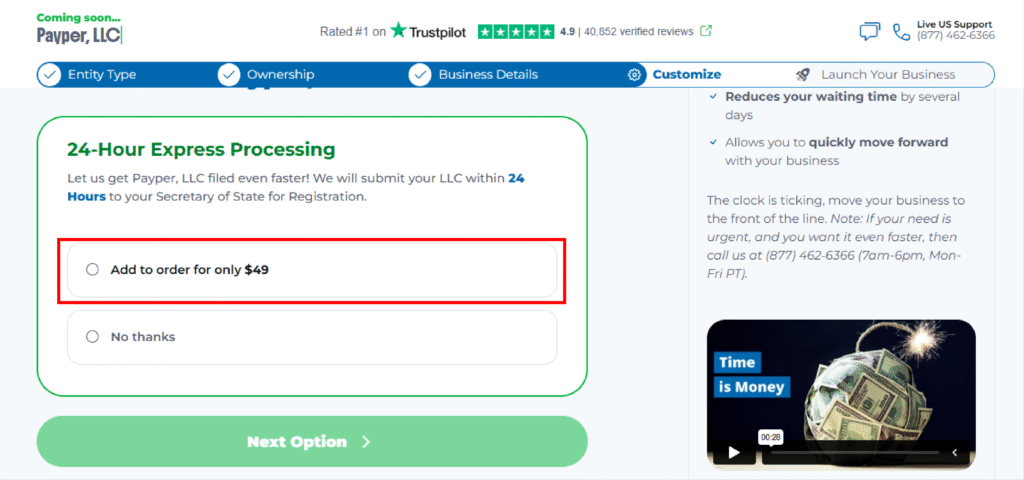

Step 10. If you need your LLC to be filed even faster you may include your 24-Hour Express Processing.

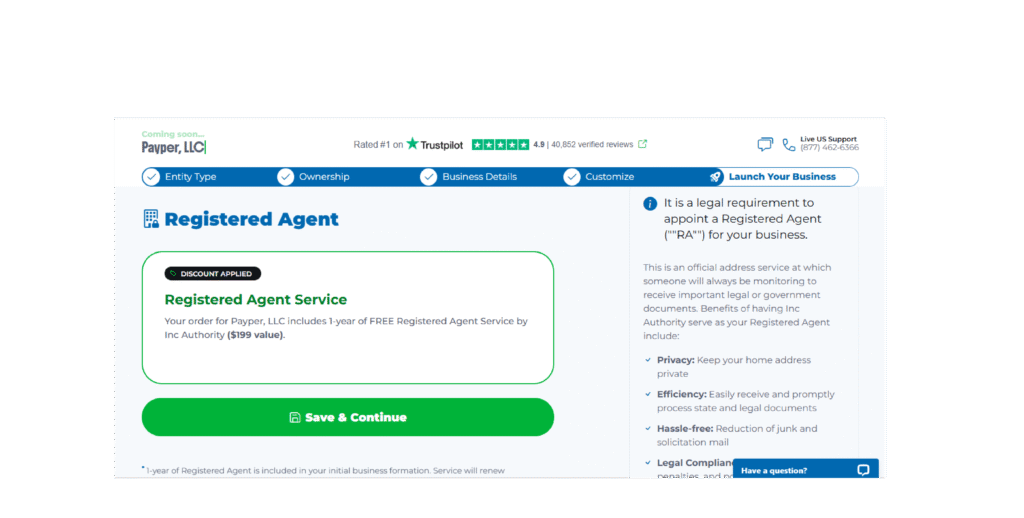

Step 11. Claim your 1-year of FREE Registered Agent Service.

Step 12. Review Your Order and Confirm Your Payment.

Step 2: Get Your EIN (Employer Identification Number)

Typically, it takes between 7 to 10 business days for Inc Authority to prepare and submit your LLC documents. Then you will get your EIN (which is included for FREE in your package) is like a tax ID for your business. You’ll need it to:

- Open a Business U.S. bank account

- Register with Stripe

Step 3: Get a U.S. Bank Account Using Payoneer

To receive Stripe payouts, your U.S. LLC needs a U.S. bank account. Traditional banks in the U.S. require in-person visits and SSNs—which are out of reach for most Indian entrepreneurs.

That’s Where Payoneer Comes In

Payoneer gives you:

- A U.S. receiving account (with routing and account number)

- No SSN or U.S. visit required

- Stripe-compatible details for payouts

- Low fees and easy global transfers

Why Payoneer Is Perfect for Indian Founders:

- Fully online onboarding

- Multicurrency accounts (USD, EUR, GBP, and more)

- Seamless Stripe integration

- Competitive conversion rates

Once your Payoneer account is ready, connect it to your Stripe dashboard—and you’re in business.

Step 4: Set Up Your Stripe Account

Once your U.S. LLC and bank details are ready, it’s time to set up your Stripe account. Head over to stripe.com and sign up using your LLC’s legal name and your Payoneer U.S. bank details.

During setup, you’ll be asked for:

- Your LLC info (name, address, EIN)

- A business website or product description

- U.S. bank account (Payoneer works perfectly here)

- A valid email and phone number

Stripe’s onboarding is smooth and straightforward. Just take your time, fill everything out accurately, and you’ll be ready to accept payments globally

Conclusion

Although Stripe is invite‑only in India, you can legally use Stripe in India by forming a U.S. LLC, obtaining an EIN, and leveraging services like Bizee, iPostal1, MoreMins, and Payoneer. This approach not only unlocks Stripe’s global payment platform for your business but also establishes a professional U.S. presence. With these steps, using Stripe in India becomes entirely achievable.

This setup not only empowers you to accept global payments through Stripe, but also gives your business a professional U.S. presence and infrastructure. With the right tools and steps, what once seemed out of reach is now entirely achievable.